Get the free uba bank form and how to filled it

Show details

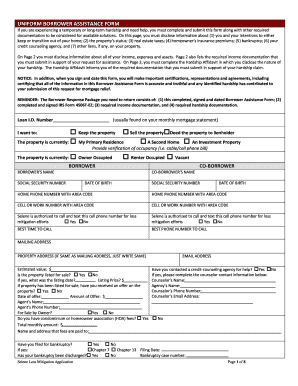

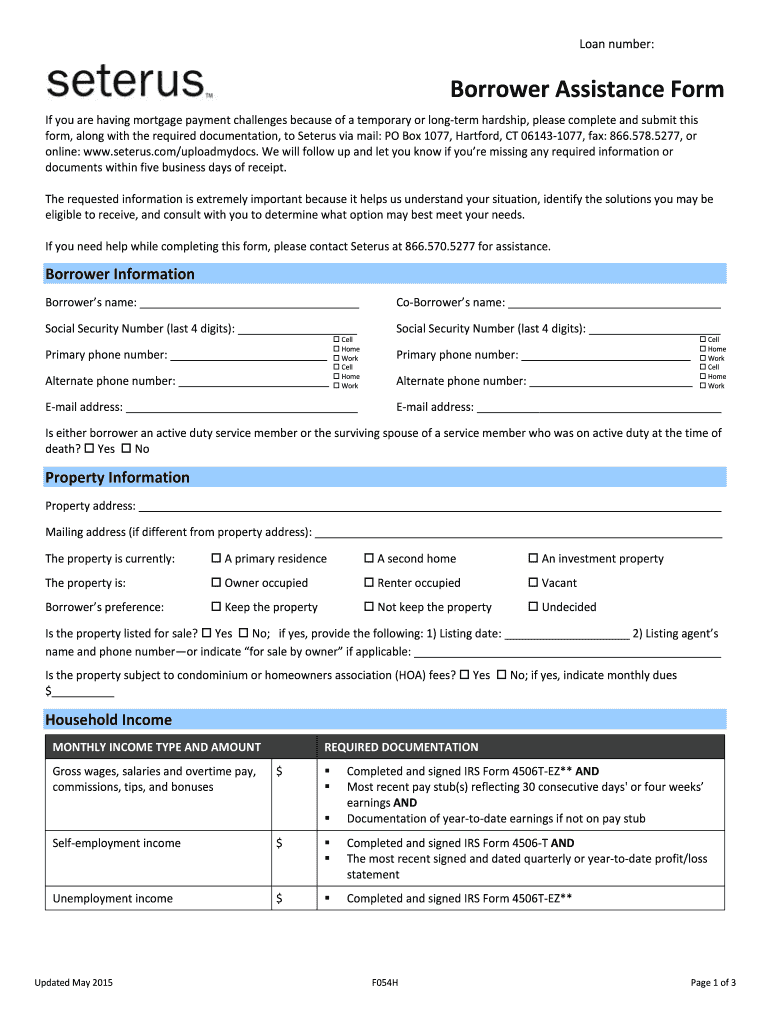

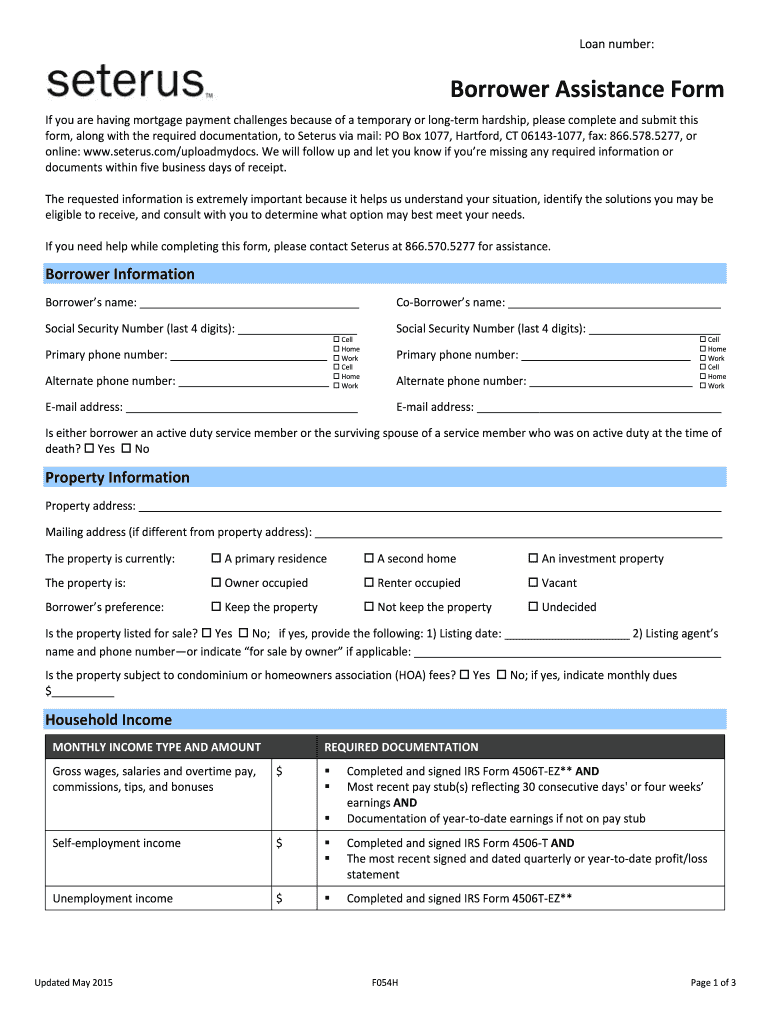

Loan Number: Uniform Borrower Assistance Form If you are experiencing a temporary or long?term hardship and need help, you must complete and submit this form along with other required documentation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uba form

Edit your ubaf form form online

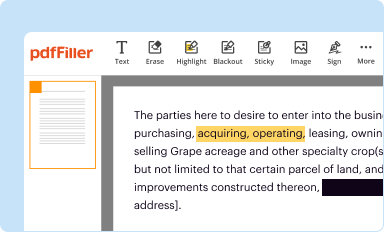

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to fill out uniform borrower assistance form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how to fill uba form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how to fill uba form fill. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out want to fill u b a form online

How to fill out how to fill uba:

01

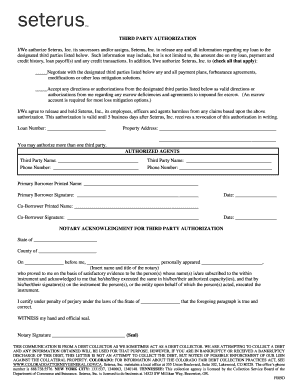

Start by gathering all the necessary documents and information that you will need to complete the form. This may include personal identification, financial records, and any relevant supporting documentation.

02

Read the instructions carefully and familiarize yourself with the specific requirements for filling out the uba form. Pay attention to any specific instructions or guidelines provided.

03

Begin by providing your personal information accurately and as requested. This may include your name, address, contact details, and any other required personal details.

04

Follow the given prompts or sections of the form to provide the necessary information. This may involve answering specific questions, providing numerical data, or selecting options from provided lists.

05

Double-check all the information you have entered to ensure accuracy and completeness. Look out for any errors or missing information that may need to be corrected.

06

If there are any sections or questions that you are unsure about, seek clarification through the provided channels. Contact the relevant authority or organization for assistance if needed.

07

Once you are confident that all the required information has been provided accurately, review the form one more time for any final edits or changes.

08

Sign and date the uba form as required. Make sure to provide any additional documentation or signatures that may be requested.

09

Keep a copy of the completed form for your records and follow the instructions for submission. Submit the form through the designated channels, whether it be online, by mail, or in person.

Who needs how to fill uba:

01

Individuals or businesses who are required to complete the uba form for regulatory or administrative purposes.

02

People who are unfamiliar with the process of filling out the uba form and need guidance.

03

Anyone who wants to ensure that they accurately and correctly complete the uba form to avoid any potential issues or delays.

Fill

how to fiil uba form

: Try Risk Free

People Also Ask about

How do I open a UBA application?

0:21 4:47 UBA Mobile App Review: Mobile Banking Has Never Been Easier YouTube Start of suggested clip End of suggested clip Device click on open an account at the bottom of the launch. Screen select your country. And thenMoreDevice click on open an account at the bottom of the launch. Screen select your country. And then select the account option that best suits your needs.

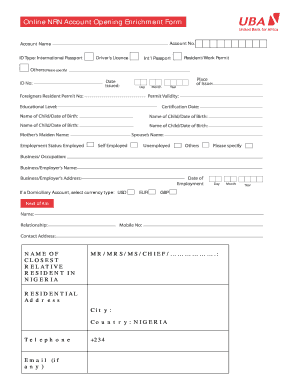

How to fill UBA account opening form?

Uba Account Opening Form PDF Details You will need to provide some basic information about yourself, including your name, address, and date of birth. You will also need to provide proof of identity and residency. Once you have filled out the form, you can submit it online or take it to a UBA branch.

Can I open a UBA account without going to the bank?

No need to visit the bank The UBA Online Account is a unique account designed for people who desire to carry out their banking activities purely online, without visiting a bank branch.

What is required to open UBA?

UBA Current Account Completed Account Opening Form. 2 passport photographs. Valid means of identification; national ID, international passport, recent voter card, driver's license. Utility bill not exceeding 3 months old.

What documents are required for bank opening?

Passport, Driving Licence, Proof of possession of Aadhaar Number, Voter's Identity Card issued by Election Commission of India, Job card issued by NREGA duly signed by an officer of the State Government, Letter issued by the National Population Register containing details of name and address.

Can I open a bank account online without going to the bank in Nigeria?

Opening a bank account can also be very easy if you decide to open it online. There are some banks in Nigeria where you can easily open an account. There are different bank accounts one can operated in Nigerian banks, they are listed below: Savings account.

How can I update my UBA profile online?

Kindly click on My profile >>> Security settings >>> Update My User ID. Authenticate with Secure pass / and click submit.

Can I open bank account online without visiting bank?

You can also open an account through the bank's website or mobile app. What type of savings account should I open?

What are the requirements to upgrade my UBA account?

Follow the prompt to get your account number and you can visit any of our branches with a valid ID - (Voters' card, National ID, International passport or Drivers' license), 2 passport photographs and a recent utility bill (not exceeding 3 months) to update your account. Thank you.

How to fill out UBA form?

Here's how it works Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Send how to fill uba form fill via email, link, or fax. You can also download it, export it or print it out.

How can I change my UBA transfer limit?

How do I increase my transaction limit? The default limit is 200k with pin and 1m with secure pass. To increase your limit up to 5 million, you have to fulfill the e-indemnity on the app.

Can I open UBA bank account online?

Opening a UBA account is easier than ever before, that is why we have a wide range of accounts to fit everyone. Regardless of situation or lifestyle, you can start online.

How to fill UBA customer data update form?

Postal Address: Residential address: Mobile/telephone number: Email Address: Reason for update: Account No. : Type of ID: ID Number: Signature Date: Are you a resident non-Ghanaian?

Is it possible to open a UBA bank account online?

Opening a UBA account is easier than ever before, that is why we have a wide range of accounts to fit everyone. Regardless of situation or lifestyle, you can start online.

What are the steps for account opening form?

7 steps to take to open a savings account Choose how to apply. Gather your identification. Provide contact details. Select a single or joint account. Accept the terms and conditions. Submit your application. Fund your new account.

What do I need to open an account at UBA?

What you will need Account opening form. A valid ID (International passport/Driver's license/National ID/Voter's card) A passport photograph. Utility bill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit uba bank form and from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your uba bank form and into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send uba bank form and for eSignature?

When you're ready to share your uba bank form and, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my uba bank form and in Gmail?

Create your eSignature using pdfFiller and then eSign your uba bank form and immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

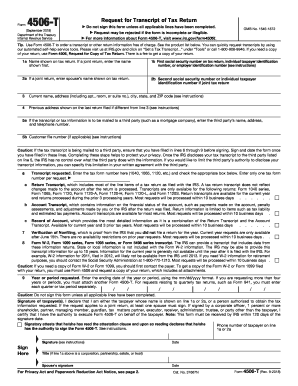

What is uba bank form?

The UBA bank form is a financial document used by customers to apply for banking services offered by United Bank for Africa (UBA), such as opening a new account or applying for loans.

Who is required to file uba bank form?

Individuals or businesses seeking to open an account, apply for loans, or access other banking services from UBA are required to file the UBA bank form.

How to fill out uba bank form?

To fill out the UBA bank form, one must provide personal or business details, including name, address, contact information, identification, and any other required documentation, ensuring all information is accurate and complete.

What is the purpose of uba bank form?

The purpose of the UBA bank form is to collect necessary information from customers to facilitate the provision of banking services, ensure compliance with regulatory requirements, and verify the identity of account holders.

What information must be reported on uba bank form?

The information that must be reported on the UBA bank form typically includes the applicant's full name, address, date of birth, identification number, contact details, occupation, and specific banking service requested.

Fill out your uba bank form and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uba Bank Form And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.